Currency exchange rates significantly influence global real estate markets, impacting property prices and international investment demand. A stronger local currency may decrease property affordability for foreign investors, while a weaker one can boost local values. International investors must navigate these fluctuations to make informed decisions, optimizing strategies and mitigating risks in a dynamic market.

“Unraveling the intricate dance between currency exchange rates and real estate markets is essential for investors worldwide. This article delves into the profound impact of exchange rate fluctuations on global property values and investment strategies. We explore the direct connection between currency movements and real estate dynamics, shedding light on how international investors navigate these changes.

Furthermore, we analyze the broader economic effects on local industries, identifying potential booms and busts. By understanding these trends, investors can strategically manage risks and capitalize on opportunities in diverse global real estate markets.”

The Link Between Currency Rates and Real Estate Markets

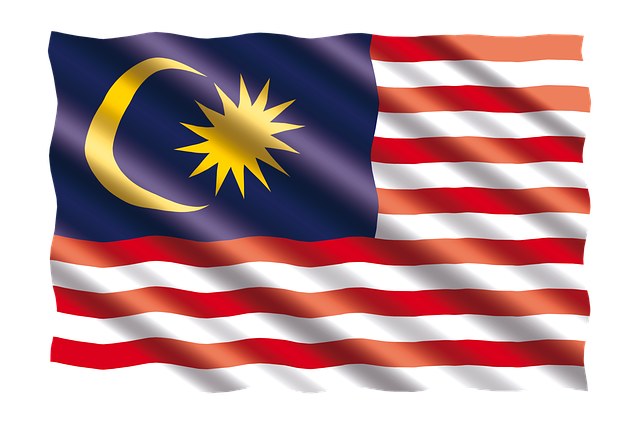

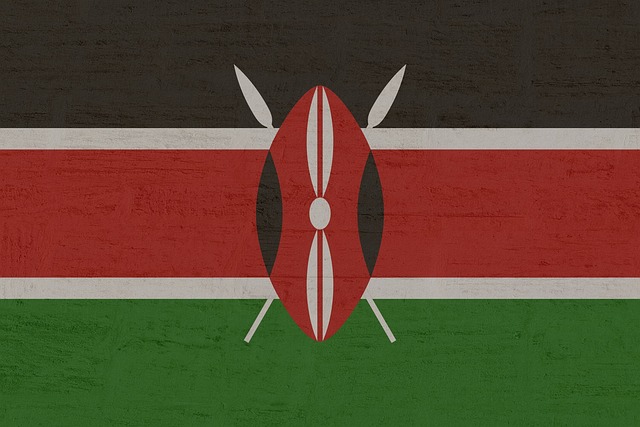

The fluctuation of currency exchange rates can significantly influence various sectors, including the real estate market. When considering a globalized world where investments often cross borders, understanding the dynamics between currencies and properties is paramount. For instance, in countries with volatile currencies, property prices may be more susceptible to swings in exchange rates. Investors from abroad might face challenges when converting their home currency to purchase local real estate, potentially affecting demand.

Real Estate markets are intricately tied to economic factors, and currency rates play a pivotal role in cross-border transactions. Changes in exchange rates can impact the affordability of properties for international investors, leading to shifts in market trends. As such, keeping abreast of currency movements is crucial for both real estate developers and investors looking to navigate this dynamic landscape.

– Explore the direct relationship between exchange rates and property values

The fluctuations in currency exchange rates can significantly influence the real estate market, as property values are directly tied to these rates. When a country’s currency strengthens against others, it often leads to a decrease in property prices for foreigners looking to invest in that specific market. This is because their purchasing power increases when they have more of their home currency to spend abroad. Conversely, a weakening currency can boost real estate values, as domestic investors may seek assets denominated in the local currency to protect themselves from inflation and economic uncertainties.

For instance, consider a scenario where a popular tourist destination experiences a rise in its local currency’s value against major global currencies. This could make purchasing property in that location more expensive for foreign visitors, potentially leading to a decline in demand and subsequent price adjustments. On the other hand, local residents may see this as an opportunity to invest in real estate at what they perceive as lower prices due to their stronger domestic currency.

– Examine how fluctuations impact buying/selling dynamics for international investors

International investors in the real estate market are keenly aware that currency exchange rate fluctuations can significantly impact their buying and selling dynamics. When a country’s currency strengthens, the cost of purchasing property in another currency decreases, making international investments more attractive and potentially increasing demand from foreign buyers. Conversely, a weakening currency makes overseas properties pricier for investors, which may deter some but could also create opportunities for those seeking to capitalize on lower prices.

These fluctuations can lead to volatile market conditions, affecting investment strategies and return expectations. For instance, a sudden surge in the local currency against other major currencies might prompt investors to lock in profits or reevaluate their portfolios, while a steady decline could encourage new investments seeking better value abroad. Understanding these dynamics is crucial for real estate investors navigating global markets to make informed decisions based on current exchange rate trends.