Navigating foreign Real Estate ownership requires understanding diverse local regulations, including visa rules, tax implications, and property restrictions. Compliance involves thorough research, legal consultation, and adherence to anti-money laundering laws. Advanced planning, staying informed, building relationships, and leveraging networks are key strategies for successful international deals, ensuring risk mitigation and profitable, sustainable investments.

“Navigating foreign ownership regulations is crucial for anyone looking to invest in international real estate. This comprehensive guide helps you understand the intricate web of laws affecting foreign buyers, offering insights into critical areas like understanding local regulations and compliance strategies.

Learn how to successfully navigate legal requirements, ensuring smooth transactions. From recognizing potential challenges to implementing effective strategies, this article equips you with the knowledge to confidently participate in global real estate markets.”

Understanding Foreign Ownership Laws in Real Estate

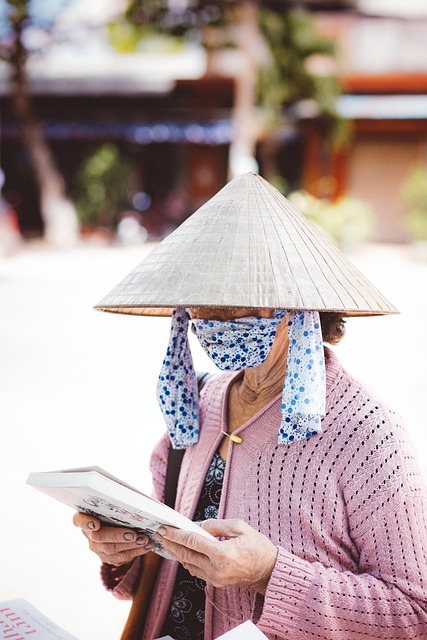

Navigating foreign ownership regulations in real estate requires a thorough understanding of local laws and policies, which can vary significantly from one country to another. Each jurisdiction has its own set of rules governing non-resident or foreign individuals and entities buying property within its borders. These regulations aim to balance facilitating international investment with protecting the local market, economy, and national security interests.

Foreign investors interested in Real Estate must be well-versed in matters such as visa requirements, tax implications, reporting obligations, and restrictions on certain types of properties or transactions. Thorough research and consultation with legal experts are crucial steps before diving into the foreign real estate market. Understanding these laws not only ensures compliance but also paves the way for a smoother investment journey and maximum returns.

Navigating Legal Requirements and Compliance

Navigating foreign ownership regulations in real estate requires meticulous care to ensure compliance with legal requirements. Each jurisdiction has its own set of rules and restrictions, from registration procedures to reporting obligations. Investors must thoroughly understand these guidelines to avoid legal pitfalls and potential fines. Failure to adhere to local laws can result in delays, complications, or even the forfeiture of property rights.

Compliance involves more than just understanding the rules; it necessitates proactive measures. This includes engaging legal experts familiar with foreign ownership laws, keeping abreast of regulatory changes, and implementing robust internal controls. By doing so, investors can ensure their activities remain within legal bounds, facilitating smoother transactions and fostering long-term success in the real estate market.

Strategies for Successful International Real Estate Deals

Navigating foreign ownership regulations is a critical step in successful international real estate deals. To ensure smooth transactions, investors should thoroughly research and understand local laws and policies. This includes obtaining necessary licenses and permits, complying with anti-money laundering (AML) regulations, and adhering to restrictions on certain types of properties. Engaging experienced legal counsel and local partners can significantly facilitate this process by providing expert insights and guidance tailored to each jurisdiction.

Effective strategies for navigating these regulations include advanced planning, staying updated on regulatory changes, and building strong relationships with local stakeholders. Investors should also be prepared to adapt their acquisition strategies based on market conditions and legal constraints. By prioritizing compliance and leveraging professional networks, foreign investors can mitigate risks and capitalize on opportunities in the global real estate market, ultimately achieving profitable and sustainable investments.